Every stock has a story.

Hope you had a great Thanksgiving with your friends and family. Still full 😂

We’re very thankful for you- our readers who appreciate what’s history and see it’s impact that shape the companies we invest in today.

As a token of our appreciation, we are offering 25% off the entire Ticker History Wall Street collectible store with code ‘Thanksgiving’ at check out. Grab a unique gift for yourself, a colleague, friend or family member.

Thank you for reading, liking, subscribing, commenting, and sharing.

Let’s take a look at some of the biggest news in markets, stocks, and business from this week in history.

December 3, 2001 – Enron Files for Bankruptcy 📅

In one of the largest corporate meltdowns in U.S. history, Enron Corporation filed for Chapter 11 bankruptcy this week in 2001. The company had engaged in massive fraud for years, hiding billions in debt, inflating assets, and using questionable mark-to-market accounting practices.

Whistleblower Sherron Watkins, head of Enron Global Finance, saw accounting problems with an energy project in Nigeria and brought them to the attention of CEO Ken Lay. After investigating further, he saw how deep rooted the problems were and formed a crisis management team in response. It was too late- years and years of mismanagement and lack of oversight led to the company’s collapse as the information became public.

In a matter of weeks, tens of billions of dollars in shareholder value were wiped out and thousands lost their jobs. Regulatory changes were passed in the aftermath, including the creation of the Sarbanes-Oxley Act to ensure stricter financial reporting standards for public companies.

For historic stock certificates like this rare post-bankruptcy Enron print from 2002, check out the Ticker History Shop.

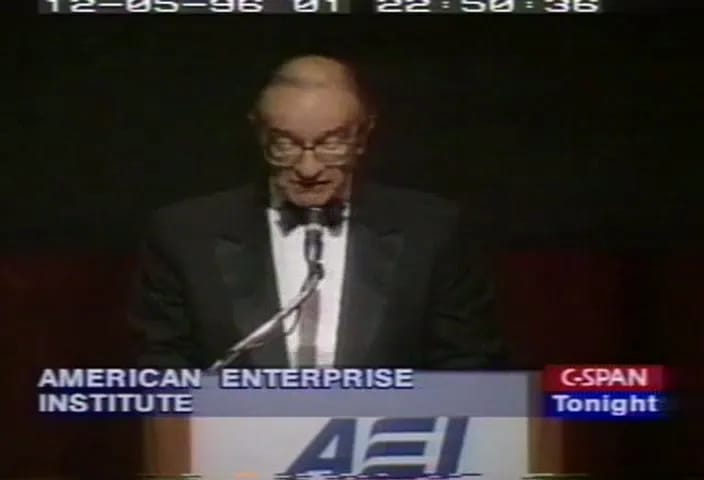

December 5, 1996 – Alan Greenspan’s “Irrational Exuberance” Speech 📅

While speaking at the American Enterprise Institute, Federal Reserve Chairman Alan Greenspan spoke about “irrational exuberance” in the stock market. Greenspan questioned whether stock prices were climbing to unsustainable levels based on speculation instead of company fundamentals.

The next morning, the Dow Jones dropped 2.3%, Japan’s Nikkei fell over 3%, and the German and London markets 4%.

Stocks recovered, with investor optimism in the dot com boom causing the Dow Jones to almost double to 12,000 less than three years later. Though it came much later than he predicted, the bubble eventually burst in 2000, with the NASDAQ falling over 75% from its peak.

Federal Reserve Chair Alan Greenspan lectures investors on inflated asset values, causing a global market crash

December 6, 1974 – The Bear Market Hits Bottom 📅

Fifty years ago, the stock market hit its lowest point during one of the worst bear markets in history. Over two years, the Dow Jones had dropped by 43%, one of the biggest declines in U.S. history. The S&P 500 closed at just 65.01, compared to over 6,000 today. During this time, the economy experienced high inflation, with rates rising to 11.3%.

The market crash was due to a mix of factors. The Bretton Woods Agreement, an international system which placed a fixed rate on gold at $35 per ounce, fell apart, which led to the devaluation of the U.S. dollar. Investor confidence was also hurt by the resignation of President Nixon and the oil crisis, and many pulled their money out of the market.

It would take about 20 years for the stock market to fully recover.

The 1970’s was an extremely tumultuous time for American politics and economics.

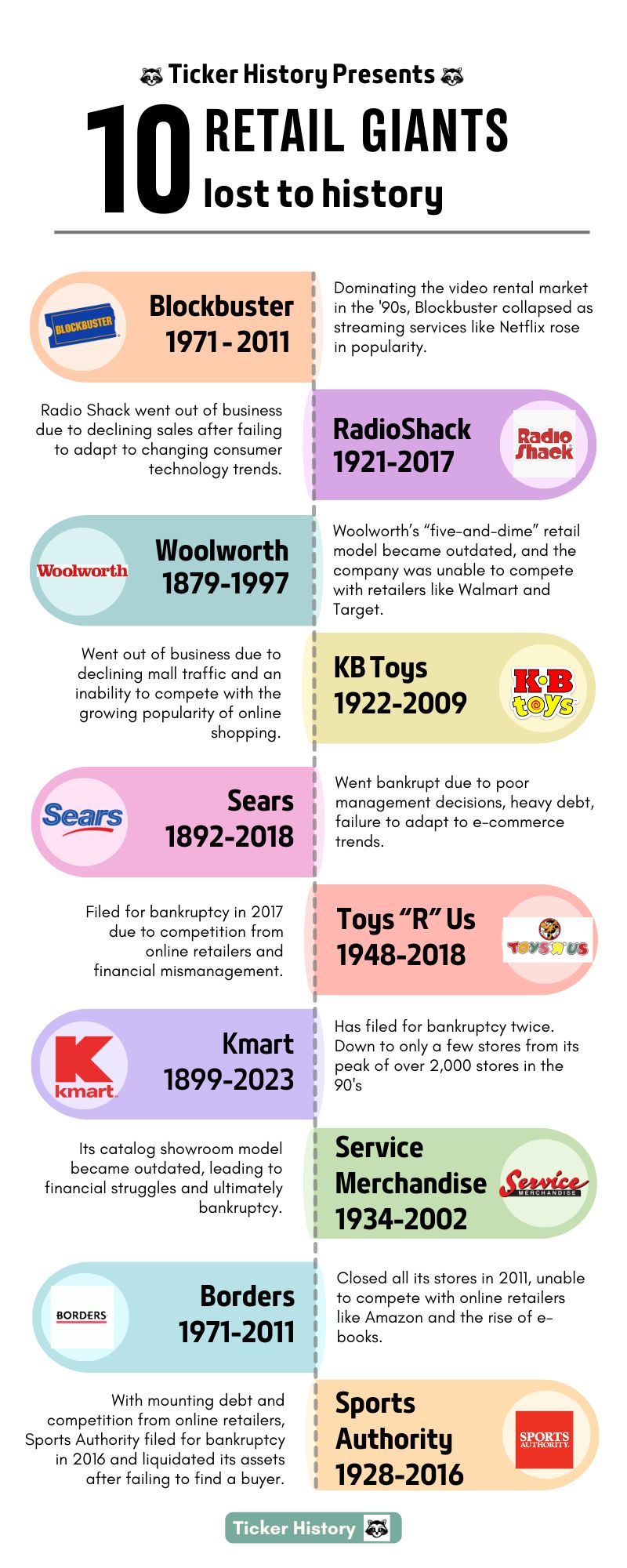

Why do once great retailers go out of business?

Not keeping up with trends in online retail

Outdated sales models

Emerging technology makes their product line obsolete or unprofitable

Stay current, or become irrelevant.

Market Quotes: Thirty Years Ago 📅

“In business, the rearview mirror is always clearer than the windshield.”

-Warren Buffett at the 1994 Berkshire Hathaway Annual Meeting

“The Internet is becoming the town square for the global village of tomorrow.”

-Bill Gates at the 1994 Comdex Trade Show

“The key to making money in stocks is not to get scared out of them.”

- Peter Lynch, 1994

Market Birthdays 📅

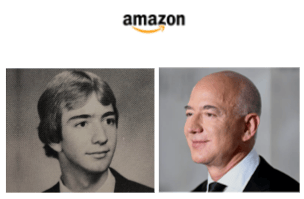

Jeff Bezos, Founder and former CEO of Amazon

December 4th, 1964

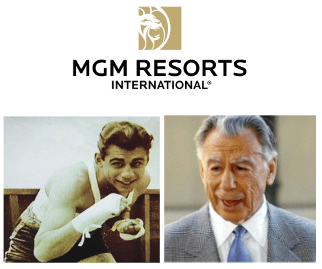

Kirk Kerkorian, Owner of MGM Resorts International

December 5th, 1917

Looking Forward 📅

That’s all in the past- what can we look forward to this week?

Salesforce (12/3), GameStop (12/4), and Lululemon (12/5) earnings reports

Apple iOS 18.2 released (12/8)

Costco releases November results, a leading indicator for holiday sales (12/4)

Cyber Monday, the peak of online shopping (12/2)

Bureau of Labor Statistics releases unemployment rate (12/6)

Wishing you the best of luck this trading week. May your puts print and your calls cash in, and always remember that real wealth comes from friends and family.

Like what you read? Don’t forget to comment, subscribe, and share with a friend! |

Own a piece of Wall Street history. Check out the Ticker History Shop for stock certificates from your favorite companies. |